Trump aside, OPEC should look at its own unhappy history before getting carried away with the oil price.

Is this really 2018? It started to sound a lot like 2008 in Saudi Arabia on Friday, as the kingdom’s oil minister argued that the world could tolerate a higher crude price.

“I haven’t seen any impact on demand with current prices,” Khalid Al-Falih told reporters at the meeting of OPEC and non-OPEC producers in Jeddah. Arguing that the energy intensity of global economic growth hadn’t declined, he offered the view that “there is the capacity for higher prices.”

President Trump certainly didn’t appreciate the sentiment, firing off a tweet that accused OPEC of promoting “artificially high prices” which “will not be accepted.”

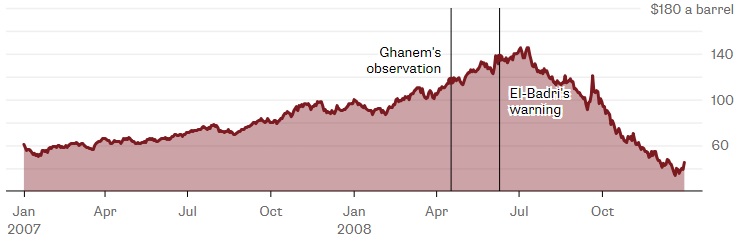

Yet setting aside Trump’s unique approach to geopolitics, the Saudi comments are indeed troubling. They are an eerie echo of comments made almost exactly a decade earlier by a former OPEC grandee: Libya’s Shukri Ghanem. The world economy “has not reached the tipping point where it can’t accept higher prices,” Ghanem said back in April 2008.

Little did he realize just how close that tipping point was. West Texas Intermediate crude, which had touched a record $116.97 a barrel the previous day, continued to climb for another 3 months as OPEC insisted it didn’t need to raise production. But then the collapse came, and it was quite a crash. After trading above $145 a barrel in the first half of July, WTI was below $40 by the end of the year.

Of course, oil prices are nowhere near as high as a decade ago. But it’s startling how quickly the lessons of 2008, or indeed the last price crash of 2014, are being ignored — even if they’re unlikely to have been forgotten.

When OPEC met in May, oil ministers were talking quite casually about $50 a barrel as a good price for crude. By the time of the December meeting, several were suggesting that a “fair” price for oil was $70 a barrel and at least one put it higher. Now that OPEC’s basket of crudes has reached that $70 level, the target appears to have mysteriously moved upwards again. This is mission creep, OPEC-style.

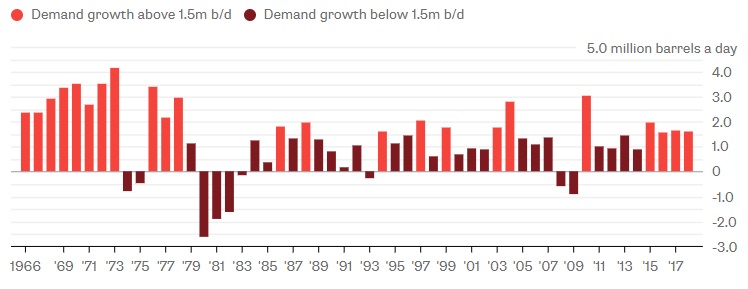

Global demand does indeed seem remarkably robust. OPEC sees it increasing by 1.6 million barrels a day this year. If that happens, it would be the first time since the early 1970s where we’ve had four consecutive years of oil demand growing by more than 1.5 million barrels a day.

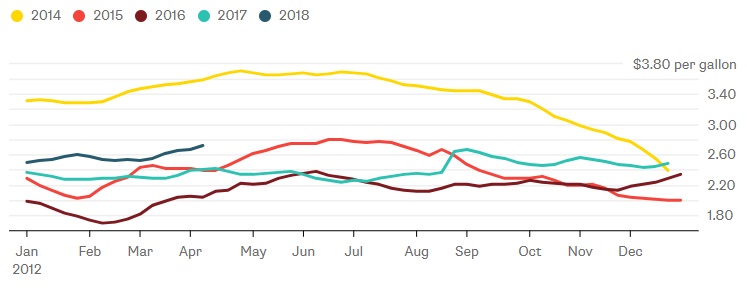

While higher crude prices would naturally be expected to boost spirits in the oil-dependent economies of the Middle East and elsewhere, they may have a chilling effect elsewhere. The growth of U.S. gasoline demand has already started to slow after pump prices rose late last year, and prices are still heading up.

If crude reaches $80 a barrel by the middle of the summer driving season, those gasoline prices could be pressing $3.30 a gallon. Al-Falih might not have seen any demand impact yet, but that could change very quickly — especially with Trump on the rampage.

Not everyone was as sanguine as Mr Ghanem a decade ago. OPEC’s then Secretary General Abdalla el-Badri sounded a warning a couple of months later. High prices were “not a bonanza” for OPEC because they had the potential to “destroy everything” by curbing oil demand, the chief revenue-generator for most of his group’s members. Al-Falih and his boss Mohammed bin Salman, would do well to remember his words.